Group managing director Robert Tan Chung Meng said IGB is awaiting approvals from the authorities and hopes to start construction in early 2010.

The two towers, which will be built similar to the existing 35-storey The Gardens North and South Office Towers, will offer 600,000 net sq ft of commercial space, Tan said.

They will be built on a 0.8ha site, which was originally meant for a convention centre, and later two blocks of high-end condominiums.

"We were toying with the idea to build condominiums or office towers. There are some residential developments coming up opposite MVC and we don't intend to compete with them," Tan said.

"MVC has become very much a commercial and retail hub so we decided to go with the office towers to take advantage of the development's MSC status, and to cater for rising demand," he added.

Tan was speaking to Business Times in Kuala Lumpur at the launch of Mid Valley City MSC Malaysia Cyber Centre One Stop Centre recently.

The centre was launched by Multimedia Development Corp chief executive officer Datuk Badlisham Ghazali.

Mid Valley City Sdn Bhd executive director Anthony P. Barragry also attended the event.

MVC received MSC Malaysia Cybercentre status on September 11 2008 under the MSC Malaysia National Roll-Out plan.

IGB pumped RM15 million into MVC, to enable fibre-optic connectivity through-out the mixed-development hub.

Barragry, meanwhile, said IGB will apply for MSC status for the two new office towers and it expects the take up for the properties to be as good as The Gardens North and South Towers.

According to Barragry, the North and South Towers are currently 95 per cent and 65 per cent leased, respectively.

Revenue from office rentals, which stood at RM55 million last year, is also expected to rise this year.

He added that MVC would make up more than 41 per cent of IGB group revenue for the year ending December 31 2009.

More Malaysians are moving online to search for properties, says the Group Executive Chairman of iProperty.com Malaysia Patrick Grove.

"Despite the economic downturn, iProperty.com Malaysia remains popular as more and more Malaysians move online to search for properties," he said.

Grove added that the company, which offered the largest online database of properties for sale and rent in the country, has been recording an average month-on-month web traffic increase of over 15 per cent.

Meanwhile, iProperty.com Malaysia emerged winner of the Online Media of the year 2009 award, beating other favorites such as Google, Yahoo!, and Microsoft.

"While most companies are struggling to sustain their business and improve their market standing after the recent economic downturn, iProperty.com Malaysia has managed to remain as the number one property portal in Malaysia," Grove said.

iProperty.com Malaysia, launched in 2007, has over 80,000 property listings online.

-- BERNAMA

The price translates into about RM2,200 per sq ft, indicating that the property market in the Kuala Lumpur City Centre area is still firm.

Dijaya Corp Bhd (5401), a property developer, is buying the land in Jalan Ampang on which the historical Bok House used to sit for RM123 million cash.

The price translates into about RM2,200 per sq ft (psf), which is slightly below the RM2,588 psf that Sunrise Bhd paid last year for the land where Wisma Angkasa Raya is located.

The price also means that the property market in the Kuala Lumpur City Centre (KLCC) area is still firm.

"I think it's a good indication for the market. It's a positive sign," Zerin Properties founder and chief executive Previndran Singhe said.

Dijaya, famous for its Tropicana branded properties, is likely to build expensive units on the prime land, a stone's throw from the Petronas Twin Towers.

"It will also create an opportunity for the group to venture into the high-end property market given that available development land within the KLCC area is scarce," it said in a statement to Bursa Malaysia yesterday.

Dijaya has paid the 10 per cent deposit to the seller, Mercury Property Management Sdn Bhd. However, there are two private caveats, a legal instrument that stops any development on the land. The first caveat was lodged by Ideal Sierra Development Sdn Bhd.

Dijaya will pay the balance two months after the Ideal caveat is cancelled or by February 24 next year. It will use internal funds and loans to settle the purchase.

The 55,929 sq ft land, which sits between Angkasa Raya and Wisma BSN in Jalan Ampang, is where tycoon Chua Cheng Bok built his mansion in 1929.

Historians and conservationists had opposed the demolition of Bok House in 2006, considering it a national heritage and tourist attraction.

Chua, who initially ran a business repairing bicycles and carriages, was the founder of car distributor Cycle and Carriage, which distributes Mercedes-Benz cars in the country.

DNP Holdings Bhd (2976), a property development and investment group, will launch its most expensive residential project dubbed "Le Nouvel", worth an estimated RM1 billion, in Kuala Lumpur by end-2010 or early 2011.

Le Nouvel comprises two residential towers with 43 and 49 floors respectively, offering a total of 197 condominium units ranging from 1,800 sq ft to 4,700 sq ft. The towers will be built near Avenue K on Jalan Ampang.

"We have the approvals to do the project, but the current market conditions are unfavourable to a launch. A better timing would be a year from now," said DNP company secretary and general manager for treasury and accounts, Lee Kong Beng, after the company's shareholders meeting yesterday in Sepang.

Lee told Business Times that DNP may sell the buildings enbloc if it receives good offers.

"If somebody offers something we can't resists, then we will go for it. Otherwise, our plan is to sell the units individually," Lee said.

He declined to say how much each unit will be priced. Based on rough calculations if the market price maintains at RM2,200 per sq ft, each unit could sell for RM4 milion to RM11 million.

Lee also said DNP's immediate focus is to launch 25 units of luxury condominiums in a five-storey block along Jalan U-Thant, Kuala Lumpur, for some RM200 million, in three to six months from now.

DNP will also launch Block B and D of Verticas Residences in Bukit Ceylon, Kuala Lumpur, pending sales of Block A.

Verticas has four blocks, worth some RM800 million. Blocks A, B and C have 43 floors each, with 417 condominium units in total. Block D is a low-rise block offering only six units.

DNP has sold Block C to Kualiti Gold Sdn Bhd, a joint controlled entity, for RM139.7 million cash, while 100 units in Block A have been taken up since its soft launch in July.

"There are 67 units left in Block C. Once we have sold them, we will launch Block B and D immediately. This may happen early next year," Lee said.

Lee said he is confident that DNP will do better this year given the new launches and the market improving.

For the first quarter ended September 30 2009, DNP posted a net profit of RM9.81 million, up 23 per cent over the same quarter last year.

DNP, which has total assets worth RM936 million, is buying more land to expand its business and enhance shareholders' value, Lee said.

In a filing to Bursa Malaysia yesterday, DNP said it has bought 3.76ha of leasehold land in Bandar Sunway, Petaling Jaya, from an unrelated party for RM56 million cash.

Lee said DNP may build shop offices on the land, but plans are still preliminary.

Five hours was all it took for all the 30 superlink houses in the final phase of the award-winning Lake Edge project in Puchong, Selangor, to find buyers.

Although priced at the RM700,000 mark, developer YTL Land and Development Sdn Bhd (YTLLD) said incentives such as an eight per cent "early bird" rebate and its absorption of the legal fees related to the sale and purchase agreements helped to generate the response.

Located near to Puchong's "golden mile" of activities, the gated-and-guarded project that was launched in 2004 at prices starting from RM580,000 appeals to upgraders from the area, said YTLLD assistant manager of sales and marketing K.K. Lai.

"Some of our buyers have bought two or more units here," she pointed out, adding that the "pavilion feature" after which the terraces are named is of particular interest, since it allows the kitchen to be positioned in the centre of the house to overlook a courtyard.

The low-density, 80-acreLake Edge will consist of 422 landed units upon built-out, of which only the 30 Pavilion Terraces in the final phase and 12 lakeside bungalows (not launched yet) have yet to be completed.

The project has won a string of awards including Best Lowrise Residential Development in the 2008 Malaysia Property Awards held by the Malaysian chapter of the International Real Estate Federation (Fiabci).

This year, it was the runner-up in the Master plan category of Fiabci's world awards called Prix D'Exceilence and named Best Residential Development in the CNBC Asia Pacific Property Awards.

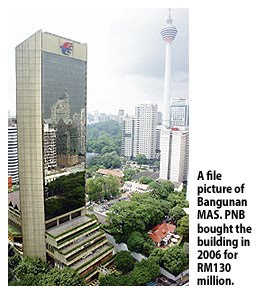

PERMODALAN Nasional Bhd (PNB) may convert Bangunan MAS into a business or five-star hotel and demolish the multi-level podium next to it to make way for a luxury serviced apartment tower worth a combined RM1 billion.

PNB bought the 35-storey building on Jalan Sultan Ismail from Malaysia Airlines (MAS) three years ago for RM130 million.

The building, the former MAS headquarters, is currently 60-70 per cent tenanted at an average RM3.50 per sq ft.

Its biggest tenants are Jabatan Kebudayaan dan Kesenian Negara and Syarikat Perumahan Negara Bhd, each occupying 10-12 floors.

It is learnt that PNB is finalising details of the building plans and working on getting the necessary approvals from the relevant authorities.

"It would be wise for PNB to build the apartments from scratch instead of the hotel. Once PNB has finalised the details of the plan, it would demolish the podium, maybe around the second half of 2010 to make way for the apartments," sources said.

The podium levels have a huge advantage of large floor plates boasting some 15,000 sq ft to 23,000 sq ft, enabling efficient space allocation for the apartments to generate higher returns.

On Bangunan MAS, PNB will be refurbishing the whole building while retaining the existing structures.

"The hotel will have world-class standards. It would be operated by a third party," a source said

PNB president and group chief executive Tan Sri Hamad Kama Piah Che Othman, when met at the launch of the Malaysia 1000 (Malaysia Top Corporate Directory) 4th Edition in Kuala Lumpur recently, told Business Times the redevelopment of Bangunan MAS would take place "soon".

He declined, however, to give details of the plan but said it would feature high-end products.

Meanwhile, the tenants of Bangunan MAS have yet to get any letter from PNB to vacate the building.

"If they want us to vacate, they should give us six months notice so we have time to find a new place," said the official of one company, who declined to be named.

Hock Seng Lee Bhd (HSL) has sold some 70% of high-end houses within a week of the launch of its first guarded-and-gated residential estate near Kuching International Airport.

Group managing director Datuk Paul Yu Chee Hoe said the project, The Leaf, had a gross development value of RM33mil.

The proposed estate comprises 34 units of semi-detached houses priced between RM700,000 and RM1mil while the 20 terraced houses are sold for RM470,000 each.

The project is due for completion by the end of next year.

“Thousands of visitors have come to see the showhouse since the launch on Nov 7.

“The development is based on a new concept, with a focus on security and landscaping,’’ Yu said yesterday.

The project is undertaken by wholly-owned subsidiary Hock Seng Lee Construction Sdn Bhd.

Yu said the company’s two other residential developments – Lavender Hills (64 units) and Samariang Aman (642 units) had virtually sold out.

Meanwhile, HSL reported record revenue of RM101.7mil and pre-tax profit of RM20.7mil for the quarter ended Sept 30, 2009. This was the first time that its quarterly revenue had exceeded RM100mil.

Group chairman Datuk Idris Buang said the latest quarterly results showed a 28% jump in revenue and 39% increase in pre-tax profit compared with the same period last year.

“With the economic stimulus packages and Sarawak Corridor of Renewal Energy projects flowing down to the tendering stage, we are hopeful of more (job) opportunities,” Idris said in a press statement.

He said the group now had RM1.8bil worth of projects in hand, with RM1.25bil unbilled.

HSL is implementing phase one of the proposed Kuching central wasteway management system, which is expected to take four years to complete.

The entire project will be carried out in four phases and will cost about RM2bil, according to the state government.