Group managing director Robert Tan Chung Meng said IGB is awaiting approvals from the authorities and hopes to start construction in early 2010.

The two towers, which will be built similar to the existing 35-storey The Gardens North and South Office Towers, will offer 600,000 net sq ft of commercial space, Tan said.

They will be built on a 0.8ha site, which was originally meant for a convention centre, and later two blocks of high-end condominiums.

"We were toying with the idea to build condominiums or office towers. There are some residential developments coming up opposite MVC and we don't intend to compete with them," Tan said.

"MVC has become very much a commercial and retail hub so we decided to go with the office towers to take advantage of the development's MSC status, and to cater for rising demand," he added.

Tan was speaking to Business Times in Kuala Lumpur at the launch of Mid Valley City MSC Malaysia Cyber Centre One Stop Centre recently.

The centre was launched by Multimedia Development Corp chief executive officer Datuk Badlisham Ghazali.

Mid Valley City Sdn Bhd executive director Anthony P. Barragry also attended the event.

MVC received MSC Malaysia Cybercentre status on September 11 2008 under the MSC Malaysia National Roll-Out plan.

IGB pumped RM15 million into MVC, to enable fibre-optic connectivity through-out the mixed-development hub.

Barragry, meanwhile, said IGB will apply for MSC status for the two new office towers and it expects the take up for the properties to be as good as The Gardens North and South Towers.

According to Barragry, the North and South Towers are currently 95 per cent and 65 per cent leased, respectively.

Revenue from office rentals, which stood at RM55 million last year, is also expected to rise this year.

He added that MVC would make up more than 41 per cent of IGB group revenue for the year ending December 31 2009.

More Malaysians are moving online to search for properties, says the Group Executive Chairman of iProperty.com Malaysia Patrick Grove.

"Despite the economic downturn, iProperty.com Malaysia remains popular as more and more Malaysians move online to search for properties," he said.

Grove added that the company, which offered the largest online database of properties for sale and rent in the country, has been recording an average month-on-month web traffic increase of over 15 per cent.

Meanwhile, iProperty.com Malaysia emerged winner of the Online Media of the year 2009 award, beating other favorites such as Google, Yahoo!, and Microsoft.

"While most companies are struggling to sustain their business and improve their market standing after the recent economic downturn, iProperty.com Malaysia has managed to remain as the number one property portal in Malaysia," Grove said.

iProperty.com Malaysia, launched in 2007, has over 80,000 property listings online.

-- BERNAMA

The price translates into about RM2,200 per sq ft, indicating that the property market in the Kuala Lumpur City Centre area is still firm.

Dijaya Corp Bhd (5401), a property developer, is buying the land in Jalan Ampang on which the historical Bok House used to sit for RM123 million cash.

The price translates into about RM2,200 per sq ft (psf), which is slightly below the RM2,588 psf that Sunrise Bhd paid last year for the land where Wisma Angkasa Raya is located.

The price also means that the property market in the Kuala Lumpur City Centre (KLCC) area is still firm.

"I think it's a good indication for the market. It's a positive sign," Zerin Properties founder and chief executive Previndran Singhe said.

Dijaya, famous for its Tropicana branded properties, is likely to build expensive units on the prime land, a stone's throw from the Petronas Twin Towers.

"It will also create an opportunity for the group to venture into the high-end property market given that available development land within the KLCC area is scarce," it said in a statement to Bursa Malaysia yesterday.

Dijaya has paid the 10 per cent deposit to the seller, Mercury Property Management Sdn Bhd. However, there are two private caveats, a legal instrument that stops any development on the land. The first caveat was lodged by Ideal Sierra Development Sdn Bhd.

Dijaya will pay the balance two months after the Ideal caveat is cancelled or by February 24 next year. It will use internal funds and loans to settle the purchase.

The 55,929 sq ft land, which sits between Angkasa Raya and Wisma BSN in Jalan Ampang, is where tycoon Chua Cheng Bok built his mansion in 1929.

Historians and conservationists had opposed the demolition of Bok House in 2006, considering it a national heritage and tourist attraction.

Chua, who initially ran a business repairing bicycles and carriages, was the founder of car distributor Cycle and Carriage, which distributes Mercedes-Benz cars in the country.

DNP Holdings Bhd (2976), a property development and investment group, will launch its most expensive residential project dubbed "Le Nouvel", worth an estimated RM1 billion, in Kuala Lumpur by end-2010 or early 2011.

Le Nouvel comprises two residential towers with 43 and 49 floors respectively, offering a total of 197 condominium units ranging from 1,800 sq ft to 4,700 sq ft. The towers will be built near Avenue K on Jalan Ampang.

"We have the approvals to do the project, but the current market conditions are unfavourable to a launch. A better timing would be a year from now," said DNP company secretary and general manager for treasury and accounts, Lee Kong Beng, after the company's shareholders meeting yesterday in Sepang.

Lee told Business Times that DNP may sell the buildings enbloc if it receives good offers.

"If somebody offers something we can't resists, then we will go for it. Otherwise, our plan is to sell the units individually," Lee said.

He declined to say how much each unit will be priced. Based on rough calculations if the market price maintains at RM2,200 per sq ft, each unit could sell for RM4 milion to RM11 million.

Lee also said DNP's immediate focus is to launch 25 units of luxury condominiums in a five-storey block along Jalan U-Thant, Kuala Lumpur, for some RM200 million, in three to six months from now.

DNP will also launch Block B and D of Verticas Residences in Bukit Ceylon, Kuala Lumpur, pending sales of Block A.

Verticas has four blocks, worth some RM800 million. Blocks A, B and C have 43 floors each, with 417 condominium units in total. Block D is a low-rise block offering only six units.

DNP has sold Block C to Kualiti Gold Sdn Bhd, a joint controlled entity, for RM139.7 million cash, while 100 units in Block A have been taken up since its soft launch in July.

"There are 67 units left in Block C. Once we have sold them, we will launch Block B and D immediately. This may happen early next year," Lee said.

Lee said he is confident that DNP will do better this year given the new launches and the market improving.

For the first quarter ended September 30 2009, DNP posted a net profit of RM9.81 million, up 23 per cent over the same quarter last year.

DNP, which has total assets worth RM936 million, is buying more land to expand its business and enhance shareholders' value, Lee said.

In a filing to Bursa Malaysia yesterday, DNP said it has bought 3.76ha of leasehold land in Bandar Sunway, Petaling Jaya, from an unrelated party for RM56 million cash.

Lee said DNP may build shop offices on the land, but plans are still preliminary.

Five hours was all it took for all the 30 superlink houses in the final phase of the award-winning Lake Edge project in Puchong, Selangor, to find buyers.

Although priced at the RM700,000 mark, developer YTL Land and Development Sdn Bhd (YTLLD) said incentives such as an eight per cent "early bird" rebate and its absorption of the legal fees related to the sale and purchase agreements helped to generate the response.

Located near to Puchong's "golden mile" of activities, the gated-and-guarded project that was launched in 2004 at prices starting from RM580,000 appeals to upgraders from the area, said YTLLD assistant manager of sales and marketing K.K. Lai.

"Some of our buyers have bought two or more units here," she pointed out, adding that the "pavilion feature" after which the terraces are named is of particular interest, since it allows the kitchen to be positioned in the centre of the house to overlook a courtyard.

The low-density, 80-acreLake Edge will consist of 422 landed units upon built-out, of which only the 30 Pavilion Terraces in the final phase and 12 lakeside bungalows (not launched yet) have yet to be completed.

The project has won a string of awards including Best Lowrise Residential Development in the 2008 Malaysia Property Awards held by the Malaysian chapter of the International Real Estate Federation (Fiabci).

This year, it was the runner-up in the Master plan category of Fiabci's world awards called Prix D'Exceilence and named Best Residential Development in the CNBC Asia Pacific Property Awards.

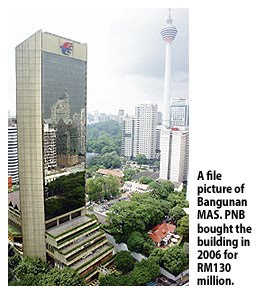

PERMODALAN Nasional Bhd (PNB) may convert Bangunan MAS into a business or five-star hotel and demolish the multi-level podium next to it to make way for a luxury serviced apartment tower worth a combined RM1 billion.

PNB bought the 35-storey building on Jalan Sultan Ismail from Malaysia Airlines (MAS) three years ago for RM130 million.

The building, the former MAS headquarters, is currently 60-70 per cent tenanted at an average RM3.50 per sq ft.

Its biggest tenants are Jabatan Kebudayaan dan Kesenian Negara and Syarikat Perumahan Negara Bhd, each occupying 10-12 floors.

It is learnt that PNB is finalising details of the building plans and working on getting the necessary approvals from the relevant authorities.

"It would be wise for PNB to build the apartments from scratch instead of the hotel. Once PNB has finalised the details of the plan, it would demolish the podium, maybe around the second half of 2010 to make way for the apartments," sources said.

The podium levels have a huge advantage of large floor plates boasting some 15,000 sq ft to 23,000 sq ft, enabling efficient space allocation for the apartments to generate higher returns.

On Bangunan MAS, PNB will be refurbishing the whole building while retaining the existing structures.

"The hotel will have world-class standards. It would be operated by a third party," a source said

PNB president and group chief executive Tan Sri Hamad Kama Piah Che Othman, when met at the launch of the Malaysia 1000 (Malaysia Top Corporate Directory) 4th Edition in Kuala Lumpur recently, told Business Times the redevelopment of Bangunan MAS would take place "soon".

He declined, however, to give details of the plan but said it would feature high-end products.

Meanwhile, the tenants of Bangunan MAS have yet to get any letter from PNB to vacate the building.

"If they want us to vacate, they should give us six months notice so we have time to find a new place," said the official of one company, who declined to be named.

Hock Seng Lee Bhd (HSL) has sold some 70% of high-end houses within a week of the launch of its first guarded-and-gated residential estate near Kuching International Airport.

Group managing director Datuk Paul Yu Chee Hoe said the project, The Leaf, had a gross development value of RM33mil.

The proposed estate comprises 34 units of semi-detached houses priced between RM700,000 and RM1mil while the 20 terraced houses are sold for RM470,000 each.

The project is due for completion by the end of next year.

“Thousands of visitors have come to see the showhouse since the launch on Nov 7.

“The development is based on a new concept, with a focus on security and landscaping,’’ Yu said yesterday.

The project is undertaken by wholly-owned subsidiary Hock Seng Lee Construction Sdn Bhd.

Yu said the company’s two other residential developments – Lavender Hills (64 units) and Samariang Aman (642 units) had virtually sold out.

Meanwhile, HSL reported record revenue of RM101.7mil and pre-tax profit of RM20.7mil for the quarter ended Sept 30, 2009. This was the first time that its quarterly revenue had exceeded RM100mil.

Group chairman Datuk Idris Buang said the latest quarterly results showed a 28% jump in revenue and 39% increase in pre-tax profit compared with the same period last year.

“With the economic stimulus packages and Sarawak Corridor of Renewal Energy projects flowing down to the tendering stage, we are hopeful of more (job) opportunities,” Idris said in a press statement.

He said the group now had RM1.8bil worth of projects in hand, with RM1.25bil unbilled.

HSL is implementing phase one of the proposed Kuching central wasteway management system, which is expected to take four years to complete.

The entire project will be carried out in four phases and will cost about RM2bil, according to the state government.

Glomac Bhd’s wholly-owned subsidiary, Glomac Damansara Sdn Bhd has entered into a sale and purchase agreement with Lembaga Tabung Haji for the disposal of a 25-storey office block for RM170.7mil.

In a filing with Bursa Malaysia yesterday, Glomac said the property would be completed and handed over to Lembaga Tabung Haji within 36 months from the date of the building plan approval. The development order was obtained on Sept 24.

“The proposed sale will enhance Glomac’s future earnings and substantially reduce Glomac’s working capital requirements for the development of this project,” it said.

Property developer Plenitude Bhd (5075) said it wants to build office towers if it can buy strategic land, namely in Kuala Lumpur's commercial centre.

"Yes, we are considering that (to build office towers)," executive director Tan Seng Chye told pressmen after the company annual general meeting in Kuala Lumpur yesterday.

Plenitude, which typically builds affordable houses, has set up a business development team to do this.

Tan said Plenitude's present land areas are mainly for residential developments and are not in locations where office blocks can be built.

"But if we find a piece of land in the Kuala Lumpur commercial centre then we will build office towers," he added.

Plenitude aims to add more acreage to its 404.7ha land area with focus mainly in Johor, Penang and the Klang Valley.

Meanwhile, executive chairman Chua Elsie said Plenitude has outlined up to six new launches next year with a total gross development value (GDV) of RM280 million for the year to June 30, 2010.

The new projects include the first ever bungalow development in Taman Desa Tebrau, Johor, and on going projects at Taman Putra Prima, Selangor, as well as Lot 88 and Bandar Perdana in Sungai Petani, Kedah.

Taman Desa Tebrau township's first bungalow development includes 55 units of 21/2-storey bungalows in Phase 12B, with a GDV of RM55 million.

"We have another 212.8ha of undeveloped land in the township that has been earmarked mainly for terrace houses," she said.

In March next year, the company plans to launch 248 units of 2-storey, 22 x 65ft terraced houses in Phase 8B of Taman Putra Prima, says Chua. The development has a GDV of RM80.95 million.

Taman Putra Prima still has some 89ha of undevelo-ped land.

Next year, it plans to launch double-storey terrace houses and semi-detached units in Lot 88 in Kedah.

Meanwhile, group general manager for sales and marketing Khaw Hock Seang said Plenitude is re-planning its Bandar Perdana project in Kedah.

"We are planning to put in a newer product mix into the development," said Khaw, adding that double storey semidees as well gated and guarded units could be in the offering.

The demand for specialised housing to cater to senior citizens is increasing, thanks to the global ageing population.

Gray & Perkins Lawyers, Sydney, partner Bernard Tan said as the ageing population has dependency on fewer children (particularly in China), there are new opportunities to build housing for the senior citizens with age-appropriate features.

“According to the source that we have from the United Nations data, one out of 10 persons is now 60 years or above and, by 2050, one out of five will be 60 years or older. By 2150, one out of three will be in this category.

“With this in mind, the trend towards building specialised housing for them is increasing,” he told the World Chinese Economic Forum with the theme, Building Business Linkages, Charting New Frontiers, at the Palace of the Golden Horses yesterday.

Tan, speaking on the subject, Global Trends in Property - Designing, Branding, Developing Iconic Projects, said such development should provide for “ageing in place” where location to amenities such as meals, hospital and nursing homes and on-site care services were included.

“The industry for specialised housing accommodation for older persons in Asia is still at its infancy. While there will be a strong demand for housing, government policies on such development have yet to be determined,” he said.

For the Malaysian scene, he said the issue of different cultures and religions needed to be considered and also the role played by the Government.

Residential housing developments would be impacted by the ageing population and developers would have to vary designs and marketing to attract an older demographic market, he said, adding: “In my view, developers needs to work closely with the Government and religious organisations to create a viable model for senior housing.”

Naza arm to get 65 acres in exchange for building RM628mil centre

Naza Group has entered into a building-for-land deal with the Government which will see it receiving 65 acres of prime land in Kuala Lumpur for building a RM628mil expo centre for Malaysia External Trade Development Corp (Matrade).

The centre and other projects planned on the land would have a combined estimated gross development value of RM15bil over a 10-year period, said International Trade and Industry Minister Datuk Mustapa Mohamed.

Naza Group joint group executive chairman and Naza TTDI Sdn Bhd chairman S.M. Nasarudin S.M. Nasimuddin said it would embark on a “comprehensive development” on the 65 acres that would surround the expo centre.

“We have four international architects bidding for the master plan and it should be finalised in mid-December.

“We plan to build shopping malls, hotels and offices,” he said after the agreement signing ceremony yesterday.

The site would be leased to Naza for 99 years.

Naza TTDI, the property arm of the Naza Group, yesterday signed a privatisation agreement via subsidiary TTDI KL Metropolis Sdn Bhd with the Government and Syarikat Tanah dan Harta Sdn Bhd (a Minister of Finance Inc company) for the land-for-construction swap.

Naza TTDI group managing director S.M. Faliq S.M. Nasimuddin said financing for the construction of the expo centre would be via a combination of internal funds and bank borrowings.

“We are speaking to a few banks,” he said.

Construction of the Matrade expo centre is expected to begin in the second quarter next year for completion in 2014.

With a gross floor area of one million sq ft, it will be the largest exhibition and convention centre in Malaysia.

The building will have three floors of exhibition space that will house 12 halls. It will be located along Jalan Duta and linked to Menara Matrade.

Mustapa said the Matrade expo centre would become an epicentre for meetings, incentives, conventions and exhibitions (MICE) activities.

“We depend on trade and MICE is a growing business. We need the right kind of facilities to attract exhibitions and investments into the country.

“In terms of facilities, we are still lagging compared with many other countries,” he said.

Mustapa said the new centre would be ideal for hosting very-large-scale exhibitions that existing centres in Malaysia could not accommodate.

“The centre is expected to fulfil the demand for bigger local and international events such as Defence Services Asia Exhibition and Conference, Malaysia International Halal Showcase and International Trade Malaysia.

“This is an important venture to stimulate investments into the country. Hopefully, Malaysia will do a better job in attracting more MICE activities,” he said.

Laman Seri Business Park unit buyers get keys ahead of schedule

Naza TTDI Sdn Bhd has kept to its record of fast completion of its products by handing over keys to buyers of the Laman Seri Business Park units in Shah Alam ahead of schedule.

The developer started to hand over keys to buyers of the business plaza of 46 exclusive high-end units comprising six blocks of four and five-storey shops and offices from Wednesday.

"The Laman Seri Business Park heralds a new dawn for a new business lifestyle in Shah Alam.

"Our aim for this development was to create a conducive place where people can work and meet within an environmentally-friendly setting," Naza TTDI group managing director SM Faliq SM Nasimuddin said at a ceremony to hand out the keys.

Naza TTDI expects a variety of businesses including three major banks, boutiques, lifestyle spas, fitness centres, popular food and beverage outlets to occupy the Laman Seri Business Park.

Completed 18 months ahead of schedule, the development was awarded the Cityscape Asia Real Estate Awards 2008 under the Future Commercial Development category.

SELANGOR State Development Corp (PKNS) will launch three new projects in Shah Alam, Selangor, worth RM140 million over the next two months.

The projects, called Ayu Qaseh and Ayu Puri, offering 170 units and 144 units of two-storey link houses respectively that are priced from RM335,000, are located in its 243ha Alam Nusantara development.

General Manager Othman Omar said he is optimistic that the properties will be taken up within three months from its launch, beginning the end of this month.

"We expect response to be overwhelming as it is the first project by PKNS with a freehold status. We are selling with the certificate of fitness (CF)," he said.

Early next month, PKNS will also launch Puncak Tropika in Kota Damansara, featuring 28 units of three-storey semi-detached houses and priced between RM1.2 million and RM1.4 million, Othman told Business Times.

The units are 80 per cent completed and their CF will be obtained in January next year.

PKNS is currently running a home ownership fair themed "Kediaman impian@PKNS" until November 25, where it will offer for sale 1,073 units of low-, medium- and high-end houses and commercial properties, priced from RM99,000 to RM1.2 million each, or a combined RM286 million.

A bulk of the properties are existing stocks in Antara Gapi, near Rawang, consisting of link houses, semi-dees and bungalows, Othman said.

Some are terraced houses in Bernam Jaya (between Sabak Bernam and Tanjung Malim), one- and two-storey shophouses and one-storey terraced homes in Kota Puteri, which is on the way to Kuala Selangor, and semi-detached houses in Cheras Jaya.

The rest include two unsold units of semi-dees in Puncak Bangi, priced from RM835,000, 111 units of medium to high-end Kasturi Idaman apartments, priced between RM205,000 and RM365,000 in Kota Damansara, and 20 units of high-end apartments, dubbed Banjaria Court, in Gombak.

"While the properties are attractive in terms of product offering, sales have been slow due to the current economic situation. We are optimistic the two units at Puncak Bangi will be taken up soon mainly because they are the last landed properties by PKNS in Bandar Baru Bangi, Othman said.

On Banjaria Court, PKNS has launched the first of four blocks. It will open for sale the remaining blocks next year, Othman said.

To boost sales, PKNS is offering RM500 downpayment and cash rebates of RM3,000 to RM8,000, including free legal fees, for all the properties.

It is also giving a RM50,000 rebate for the semidees in Cheras Jaya.

"We hope to sell 391 units worth RM55 million this month. We have achieved RM12.7 million from the sale of 48 properties since the launch," he said.

The home ownership fair also applies to Ayu Qaseh, Ayu Puri and Puncak Tropika projects.

Naza TTDI Sdn Bhd completed its commercial development, the Laman Seri Business Park, 18 months ahead of schedule.

The business park boasts 46 exclusive high-end units comprising six blocks of four and five-storey shops and offices.

The developer expects a variety of businesses, including three major banks, boutiques, lifestyle spas, fitness centres, popular food and beverage outlets, to occupy the commercial centre.

“We are pleased to once again maintain our track record of delivering our prduct ahead of schedule,” said group managing director S.M. Faliq S.M. Nasimuddin in a statement in conjunction with the key handover ceremony yesterday.

The business park, launched in March last year, was developed to create a conducive place for people to work and meet within an environment-friendly setting.

This is manifested in the generous provision of public spaces, lush green landscaping completed with synchronised fountains and water-scape and koi pond, wide footpaths and five-foot ways and public utilities.

UEM Land Holdings Bhd has a slew of property launches for 2010, primarily within the Nusajaya (Johor) and Klang Valley areas, said managing director and chief executive officer Wan Abdullah Wan Ibrahim.

“We have many more projects in Johor and we hope to seal some deals in Kuala Lumpur and Selangor. “In Nusajaya, we have a lot more on our plate,” he told StarBiz after a signing ceremony yesterday with REAL Education Group Sdn Bhd, an education services provider. Wan Abdullah said the projects in the pipeline comprised affordable, medium and high-end developments.

He was also optimistic about UEM Land’s business prospects for 2010.

“Looking at our results (for the financial year ending Dec 31, 2009), we suffered in the first quarter, recovered in the second and improved in the third.

“The fact that our results are improving consistently tells you that we are on the right path,” Wan Abdullah said, adding that the launches it had slated for next year would boost the company’s performance.

UEM Land’s net profit for the third quarter ended Sept 30 surged to RM7.54mil from RM1.11mil in the previous corresponding period despite revenue dipping to RM72.79mil from RM78.37mil previously.

The company yesterday signed a sale and purchase agreement with REAL for the latter’s purchase of 0.4ha of land to establish a kindergarten in East Ledang, Nusajaya.

REAL group chief executive officer Sim Quan Seng said the land and the construction of the kindergarten could cost as much as RM4mil.

A residential enclave set amidst gardens and ornamental waterways in an area spanning 110ha, East Ledang will be developed in seven phases with a gross development value of RM1.4bil.

Nusajaya, spanning 9,550ha, is slated to become one of the largest and most prestigious integrated urban developments in South-East Asia.

Wan Abdullah said UEM Land was in talks with parties to develop projects in Nusajaya.

“We are always on the search for strategic partners. Because of the size of Nusajaya, it is impossible for us to develop projects ourselves. In most instances, it would be a joint-venture initiative,” he said. - thestar

MALAYSIAN Resources Corp Bhd (MRCB) has new projects worth some RM6 billion to launch at Kuala Lumpur Sentral (KL Sentral), the integrated transport hub in Brickfields, before the end of the development in 2015/ 2016.

Group managing director Shahril Ridza Ridzuan said MRCB, one of the country's biggest office space providers, will launch three million sq ft of space next year.

These would include room for two luxury serviced apartment towers, an office building, and the 6-star 200-room St Regis Hotel.

Shahril said the construction for St Regis will start by mid-2010, followed by the office building.

He said the two serviced apartments towers, worth almost RM900 million, will be launched towards the end of next year.

"We have land fronting Jalan Tun Sambanthan, which we are reserving for the final phase of the KL Sentral development. We are in the midst of deciding what we want to build on the land. A decision would be made around 2012," Shahril said in an interview with Business Times in Kuala Lumpur recently.

Currently, there are RM7 billion worth of on-going projects at KL Sentral, which would be completed between 2011 and 2012.

These includes Nu Sentral Mall, a business class hotel, three office towers, an office block for CIMB Investment Group, the KL Sentral park featuring low-rise high-end offices, and 348 Sentral, comprising a 33-storey office tower and 21-storey serviced residence.

Shahril said MRCB is in talks with international operators to manage the business class hotel.

On the three office towers, Shahril said one building with 27 floors will be taken up by Pelaburan Hartanah Bhd.

The two remaining towers will have Korean interest. They will provide capital under the Daol Trust & Fund Co Ltd (Daol Fund), he said. Daol Fund is Korea's first specialised real estate fund investment and management company.

"The structure will be similar to a real estate investment trust (REIT) where the Koreans will invests in the towers, and we would manage it for them for a few years."

On replicating KL Sentral, Shahril said while it would be difficult to do that in Kuala Lumpur due to scarcity of land, there is no doubt the development would be taken international.

He said MRCB is in talks with potential parties to replicate KL Sentral in the Middle East and Asia Pacific, including in China and India.

Malaysian Resources Corp Bhd (MRCB) (1651) plans to undertake its biggest development project ever in the Klang Valley by as early as next year.

The planned project is expected to dwarf MRCB's flagship Kuala Lumpur Sentral (KL Sentral) transport hub in Brickfields.

Group managing director Shahril Ridza Ridzuan said MRCB will use part of the RM566 million raised from a rights issue to buy land for the development.

"We are planning the next big thing after KL Sentral. It would be something more exciting and bigger than any of our existing projects," Shahril said.

KL Sentral is due to complete by 2015/2016.

"We are looking at a few plots of land. Depending on the land size and location, we will decide on the best development to do," Shahril said in an interview with Business Times in Kuala Lumpur recently.

He said the group is also buying land for new commercial and residential projects in 2010.

MRCB, which has RM7 billion worth of construction jobs in hand, has proposed to offer up to 483 million new shares at an issue price of RM1.172 each.

The fund-raising exercise is targeted for completion in the first quarter of next year.

MRCB will use some of the proceeds to fund the RM800 million

Nu Mall project at KL Sentral and expand its environmental engineering and infrastructure business.

For infrastructure development, Shahril said MRCB will bid for the RM7 billion Klang Valley Light Rail Transit (LRT) extension project.

He said tenders for pre-qualification will be out soon.

"We will bid for the project either as a whole package, or in smaller packages. It would depend on what the government wants," Shahril said.

MRCB is also trying to build up its asset portfolio.

It now manages three office towers at KL Sentral and one in Shah Alam. By 2011, it would manage four new towers at KL Sentral, currently under construction.

Shahril ruled out injecting the properties into a real estate investment trust (REIT).

"We are already doing a similar structure and concept as a REIT. We are managing properties for investors for a management fee. We like what we are doing and would build on that," he said. - btimes

Boutique property developer Kuala Lumpur Metro Group will launch two resort developments and a housing project worth a combined RM300 million in Port Dickson, Bangi, and Penang, over the next eight months.

The low-profile group, which made a mark in property development when it launched its landmark project - the Legend International Water Homes in Port Dickson in 2003, is also planning to expand into China and Vietnam.

"We are looking at resort developments in China and Vietnam. We believe there is a market for resort-type products. We have identified the local partners, but plans are still preliminary," said KL Metro managing director Datuk Low Tak Fatt.

Locally, KL Metro will launch Phase 3 of the Legend Water Homes valued at RM45 million and 30 units of semi-detached houses in Bangi, worth RM25 million, by December.

By mid-2010, KL Metro will launch The Hibiscus in Penang, which features 460 units of five-star water homes at Teluk Kumbar.

The Penang development is worth some RM200 million and KL Metro is targeting buyers from Asia Pacific, Europe and the Middle East.

"Demand for water homes in Malaysia is greater than supply so we expect our projects to do very well," Low told a media briefing on the second phase of its Legend Water Homes in Kuala Lumpur yesterday.

Phase 2, which will open on November 1, offers 166 water homes, 44 garden chalets and 39 sky pool villas.

Priced from RM400,000 to RM700,000 each, some RM160 million or 99 per cent of the properties have been sold, Low said.

Majority of the buyers were from the Hong Kong, Singapore, Macau, the Middle East and some European countries, with an option to lease back at an 8 per cent gross rental income return a year.

Low said he expects 50 per cent occupancy in the first year, with average promotional room rates starting from RM550 per night to RM900.

He said KL Metro is aiming for occupancy to grow by 10 per cent per year via aggressive marketing.

"Despite the downturn of the economy and credit crunch worldwide, we still managed to complete Phase 2 three months ahead and sell all the units. We are proud of this development," Low said.

Phase 1, which has 329 units, was completed in 2006 and fully sold within two years.

The Balinese-themed resort took the "Best Architecture" and "Best Development" titles at the CNBC International Property Awards in London in 2007.

Sunrise Bhd (6165), the country's fourth biggest developer in terms of revenue, is exploring proposals to develop land in Vietnam, China and India.

ITs only venture abroad is in Vancouver, Canada, where it is planning a RM1 billion mixed development.

"We receive proposals from all over, just like any others, but we can't tie up with the economics and regulatory environment," executive chairman Tong Kooi Ong said.

Sunrise is re-engineering its project in Richmond, Vancouver, to reduce construction costs.

"We have budgeted for low selling price, which has forced us to budget for lower construction costs. If all goes well, we will launch the project in mid-2010," Tong said at a briefing to analysts in Kuala Lumpur yesterday.

On the home front, Sunrise is trying to find a niche in Iskandar Malaysia, Johor, as well as Penang, he added.

"We must have economies of scale and brand value. We can't hit and run."

According to Tong, Sunrise will still be busy with developments in Mont'Kiara for the next eight years. It has some 30ha to develop.

On whether Sunrise could surpass its 2008 earnings, Tong said he was confident that it would do well in the current year.

Last year, Sunrise made RM156.2 million net profit on RM803.9 million revenue.

It is expecting unbilled sales of RM864 million and two new strata developments in Kuala Lumpur, worth RM1.5 billion, to underpin earnings until 2011.

Most of the unbilled sales, or sales that have yet to be booked into its accounts, were from higher-margin products in the prestigious Mont'Kiara enclave.

The government will look at the feedback and if there is a need to do any adjustments, it will reconsider, says Deputy International Trade and Industry Minister

The government may do away with the real property gains tax (RPGT) based on feedback from industry players, said Deputy International Trade and Industry Minister Datuk Mukhriz Mahathir.

The RPGT will return next year at a fixed 5 per cent after it was scrapped in 2007, following the 2010 Budget announcement on October 23.

However, some industry players were upset about the tax as they feel it could hurt the market and Malaysia's effort to promote local properties to foreigners.

"We will look at the feedback and if there is a need for us to do any adjustments, we will reconsider," he said in response to media queries.

Mukhriz was launching a one-day seminar on the impact of globalisation and liberalisation to the business and real estate industry.

Mukhriz said the government had received feedback from non-governmental organisations and other agencies.

Earlier, he said the government had provided numerous incentives to the housing sector to shore up the economy as shown in the RM400 million incentives extended through the two stimulus packages.

In addition, there is a tax relief on housing loan interest of up to RM10,000 for three years in the 2009 Budget to stimulate the industry.

Meanwhile, estate agent Raine & Horne managing partner Datuk Zaki Said said the property sector does not take policy inconsistencies well.

"The international market feels uncomfortable with changes in the policy. On the part of the industry and policymakers, they are looking at the (market) scenario one of which is to curb speculation."

"But we need genuine buyers which will be good for the industry and economy," he said.

The Malaysian property market has been attracting regional buyers, including Singaporeans and there has been higher interest for expensive properties in Kuala Lumpur from Indonesian investors too.

Zaki said the market has stabilised and is expected to grow by 5 per cent to 10 per cent next year. - btimes

Developers in the Klang Valley are planning to launch more projects in the coming months as the local property market continues its recovery.

To provide industry players a platform to showcase their latest developments, The Star Media Group will be organising the first Star Property Fair in Kuala Lumpur from Nov 27 to 29.

Themed “Stylish Living”, The Star Property Fair Kuala Lumpur will be held at the KL Convention Centre halls 4 and 5.

According to Star Publications (M) Bhd group managing director and chief executive officer Datin Linda Ngiam, the economic downturn has affected the property market and there is a need for an integrated platform for property developers and prospective purchasers to meet.

“The Star Property Fair is an integrated platform because it will be an on ground event fully supported by our print, radio, magazine and online media, especially StarProperty portal.

“Through the property fair, we hope to complement the Government’s efforts in stimulating the economy especially in the property market and hasten the process of recovery. Businesses such as financial and lifestyle will subsequently benefit also,” Ngiam said.

The Star has so far organised eight annual property fairs in Penang and response from both exhibitors and visitors has been very encouraging, making it the leading property fair in Penang.

“With our established network and the strategic platform created over the years, we want to leverage on our position as a leading media group to set a new benchmark for property exhibitions in the country,” she added.

Ngiam said many affluent Malaysians were looking to invest in properties that would not only give them good long-term value but also reflect on their lifestyles.

The upcoming fair will enable visitors to view the latest offerings by renowned local developers for a broad range of property from medium to medium high-range residences, luxurious bungalows to exclusive condominiums, and commercial projects.

Visitors will also have the opportunity to obtain advice on financing options from participating financial institutions as well as government agencies that will be on hand to offer information on Employees’ Provident Fund withdrawals and on other matters.

There will also be talks and forums conducted by industry experts on various topics, including property investment, feng shui and home inspirations.

Other attractions include auctions by CIMB Property Mart and a contest for all visitors to the fair with prizes worth over RM20,000 to be won.

The property fair is open to the public from 11am to 8pm (Friday to Sunday) and admission is free.- thestar

Department store Metrojaya Bhd (9725) will close its outlet in Berjaya Times Square next week, three years after moving in as an anchor tenant.

Metrojaya, which occupies 114,000 sq ft of space at the Kuala Lumpur mall, will close its doors at the end of operating hours on Sunday and move out by month-end.

It will be the second time a retailer is leaving Berjaya Times Square. The UK's leading multi-category retailer, Debenhams, exited the mall and the country in August 2006.

Metrojaya chairman Datuk Ahmad Khairummuzammil told Business Times that its exit was part of a rationalisation exercise.

"This is purely a business decision. We feel we can do better if we focus on our other existing stores," Ahmad said, adding that it was leaving at the end of its three-year tenancy agreement.

While the outlet is profitable, Metrojaya feels that it will be better to focus on its 138,000 sq ft store in Bukit Bintang Plaza, located a stone's throw away. It plans to spend RM9 million to renovate this outlet.

Metrojaya will hold a sale from now until the closing of the store.

The store opened officially on November 21 2006, taking over the space vacated by Debenhams.

Berjaya Group's BTS Department Store Sdn Bhd had the franchise for Debenhams, but the deal was mutually terminated after three years when the business proved to be not viable.

Metrojaya, a RM400 million company, operates five other department stores apart from the one in Bukit Bintang Plaza as well as four MJ Fashion Concept Stores.

It also operates speciality store Living Quarters, Somerset Bay, East India Company and Reject Shop.

The management of Berjaya Times Square did not return calls from Business Times.

However, a quick check with the mall's leasing department revealed that it had not yet secured a new tenant for the space.